CONFIDENTIAL INVESTMENT SUMMARY

CLASS A, NEW-CONSTRUCTION INVESTMENT OPPORTUNITY

● STAMFORD, CT ●

This Opportunity is Fully Subscribed and No Longer Open for Investment

DISCLOSURE

The following information is an investment summary provided to prospective investors and others. This information is not an offering to sell a security or a solicitation to sell a security. At the request of a recipient, the Company will provide a private placement memorandum, subscription agreement and the Limited Liability Company Operating Agreement. The Managing Member in no way guarantees the projections contained herein. Real estate values, income, expenses and development costs are all affected by a multitude of forces outside the Managing Member’s control. This investment is illiquid and only those persons that are able and willing to risk their entire investment should participate. Please consult your attorney, CPA and/or professional financial advisor regarding the suitability of an investment by you.

This information is confidential and may not be reproduced or redistributed. The information presented herein has been prepared for informational purposes only and is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or fund interest or any financial instrument and is not to be considered investment advice. This presentation is for institutional use only and is not to be distributed to any party other than its intended recipient.

The following materials present information regarding a proposed creation of a special purpose vehicle (the "Issuer") which would offer securities (the “Securities”) to finance its acquisition of a portfolio of financial assets to be selected and managed by the portfolio manager referred to herein (the "Manager"). These materials have been prepared to provide preliminary information about the Issuer and the transactions described herein to a limited number of potential underwriters of the Securities for the sole purpose of assisting them to determine whether they have an interest in underwriting the Securities.

The views and opinions expressed in this presentation are those of Sterling Rhino Capital, LLC and are subject to change based on market and other conditions. Although the information presented herein has been obtained from and is based upon sources Sterling Rhino Capital believe to be reliable, no representation or warranty, expressed or implied, is made as to the accuracy or completeness of that information. No assurance can be given that the investment objectives described herein will be achieved. Reliance upon information in this material is at the sole discretion of the reader.

This data is for illustrative purposes only. Past performance of indices of asset classes does not represent actual returns or volatility of actual accounts or investment managers and should not be viewed as indicative of future results. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

Forward-looking information contained in these materials is subject to certain inherent limitations. Such information is information that is not purely historical in nature and may include, among other things, expected structural features, anticipated ratings, proposed or target portfolio composition, proposed diversification or sector investment, specific investment strategies and forecasts of future market or economic conditions. The forward-looking information contained herein is based upon certain assumptions, which are unlikely to be consistent with, and may differ materially from, actual events and conditions. In addition, not all relevant events or conditions may have been considered in developing such assumptions. Accordingly, actual results will vary, and the variations may be material. Prospective investors should understand such assumptions and evaluate whether they are appropriate for their purposes. These materials may also contain historical market data; however, historical market trends are not reliable indicators of future market behavior.

Information in these materials about the Manager, its affiliates and their personnel and affiliates and the historical performance of portfolios it has managed has been supplied by the Manager to provide prospective investors with information as to its general portfolio management experience and may not be viewed as a promise or indicator of the Issuer's future results. Such information and its limitations are discussed further in the sections of these materials in which such information is presented.

Past performance of indices or asset classes does not represent actual returns or volatility of actual accounts or investment managers and should not be viewed as indicative of future results. The comparisons herein of the performances of the market indicators, benchmarks or indices may not be meaningful since the constitution and risks associated with each market indicator, benchmark, or index may be significantly different. Accordingly, no representation or warranty is made to the sufficiency, relevance, important, appropriateness, completeness, or comprehensiveness of the market data, information, or summaries contained herein for any specific purpose.

TABLE OF CONTENTS

(click on the section name below to jump directly to that section)

This Opportunity is Fully Subscribed and No Longer Open for Investment

EXECUTIVE SUMMARY

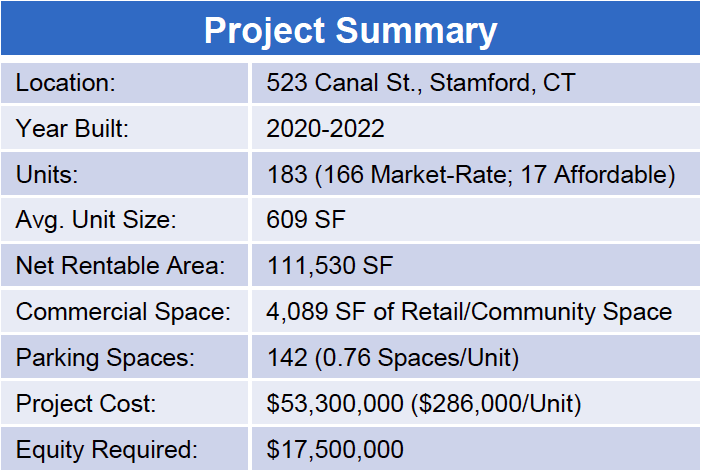

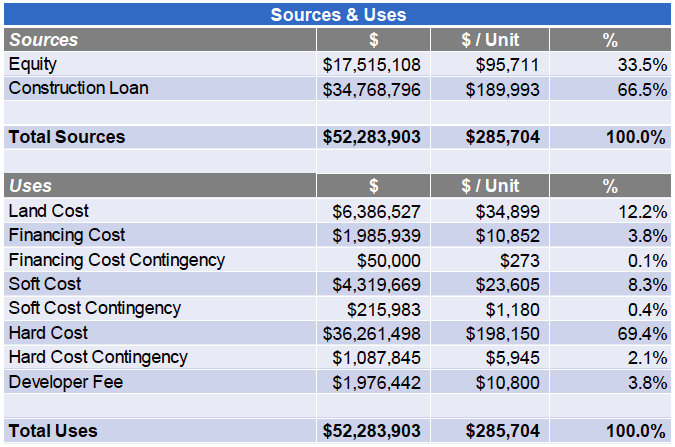

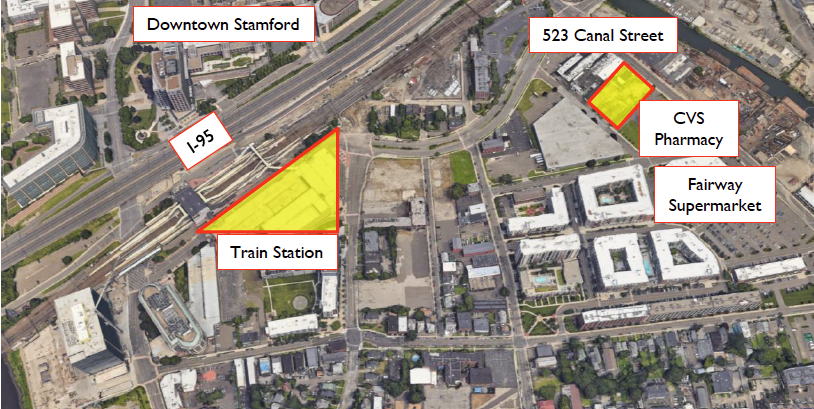

Sterling Rhino Capital is presenting an exclusive investment opportunity in the development of a 183-unit rental community on a 1.07 acre site in the Harbor Point neighborhood of Stamford, CT, in a tax-favored Opportunity Zone.

We are offering a select group of VIP investors from the Sterling Rhino Capital Investor Club the opportunity to partner with us on the general partnership side of this deal. We are acquiring an ownership stake on this Class A, 7-story, mixed-use property.

Investing alongside us in this deal not only gives you exposure to the standard LP returns for this deal, but also a share of the general partnership promote, giving you the potential for much higher overall returns.

This is a 506(c) offering, available to accredited investors only.

KEY INVESTMENT DETAILS

90/10

___________________________________

internal profit split LP/GP

25-33%

________________________________

projected avg annual return

3.0x

________________________________

equity multiple

6%

___________________________________

preferred return*

*the preferred return begins at property stabilization and refinance, estimated 12 mos.

$100,000

___________________________________

minimum investment amt

6-8 yrs

________________________________

anticipated hold period

0%

________________________________

tax on gains of invested funds

$1.05M

___________________________________

equity raise

Why This Deal Is For You!

- Your investment will be in an entity that will be registered as an Opportunity Zone fund. Therefore, if you have other investments subject to capital gains tax (e.g. Tristan Townhomes) and you put those proceeds into this fund, all capital gains tax will be deferred until 2026 (unless an extension occurs). Think of this like a 1031 exchange for the next 4 years, but without all of the rules and restrictions. Your deferred capital gains can even be from a non-real estate investment.

-

If we hold the property for at least 7 years, you get a 15% discount on capital gains when we sell. If we hold for at least 5 years, you get a 10% discount on capital gains when we sell.

-

The conservative return projections on this deal are higher than the typical, existing-asset syndications. Not taking into account your tax savings, we are conservatively expecting greater than 3x your money in 8 yrs or less.

Want to read the full 2022 1st Quarter Project Update? Click below to download.

This Opportunity is Fully Subscribed and No Longer Open for Investment

PROPERTY PROFILE

To complement the proximity to the train station, the project design appeals to young, transient renters, underserved by the existing buildings in the area. Smaller units and a higher quality amenity package will allow the Property to offer a more affordable alternative relative to older luxury buildings in the area. Currently, there are only 143 studios in Harbor Point (out of 3,400 units), with most one-bedroom rents starting at $2,400-$2,500. Studios at 523 Canal will start at $2,050.

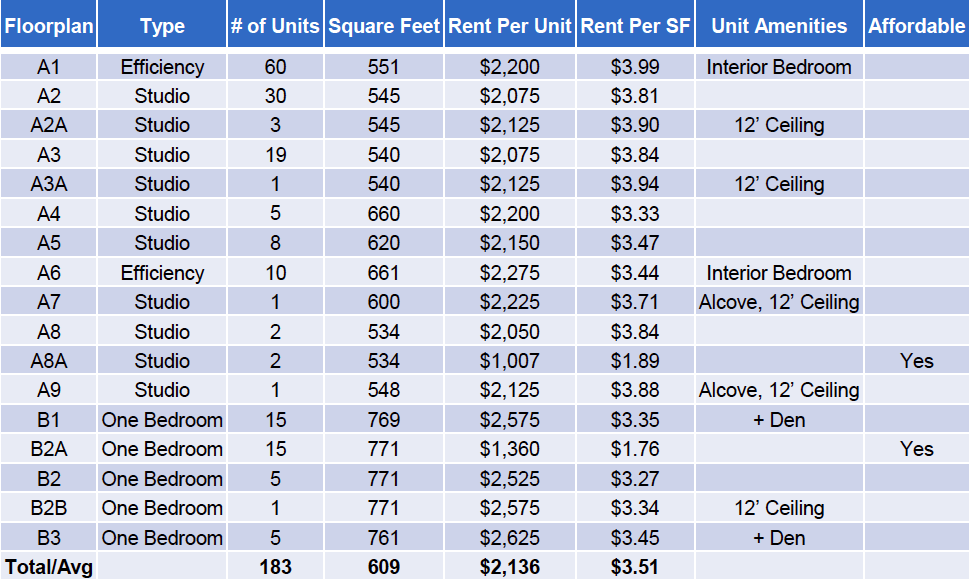

- Average unit size of 609 SF with 72 studios, 70 efficiencies, and 41 one-bed units

- Luxury interior finishes comparable to other new developments in Stamford

- Amenities will include a pool, fitness center, shared working areas, tech packages, and seamless connectivity

- Hudson Table will lease the building’s retail space and operate a coffee shop and cooking-based event space. They currently operate locations in Hoboken, NJ, and Philadelphia.

- Walking distance to the Stamford Metro North train station and a 40-minute commute to Grand Central Station in NYC.

FINANCIAL ANALYSIS

MARKET ANALYSIS

Click the button below to view or download a complete analysis of the Stamford, CT market, including:

- sales and rent comps

- info on the development partners, lead sponsor, and property manager

- Opportunity Zone benefits

FREQUENTLY ASKED QUESTIONS

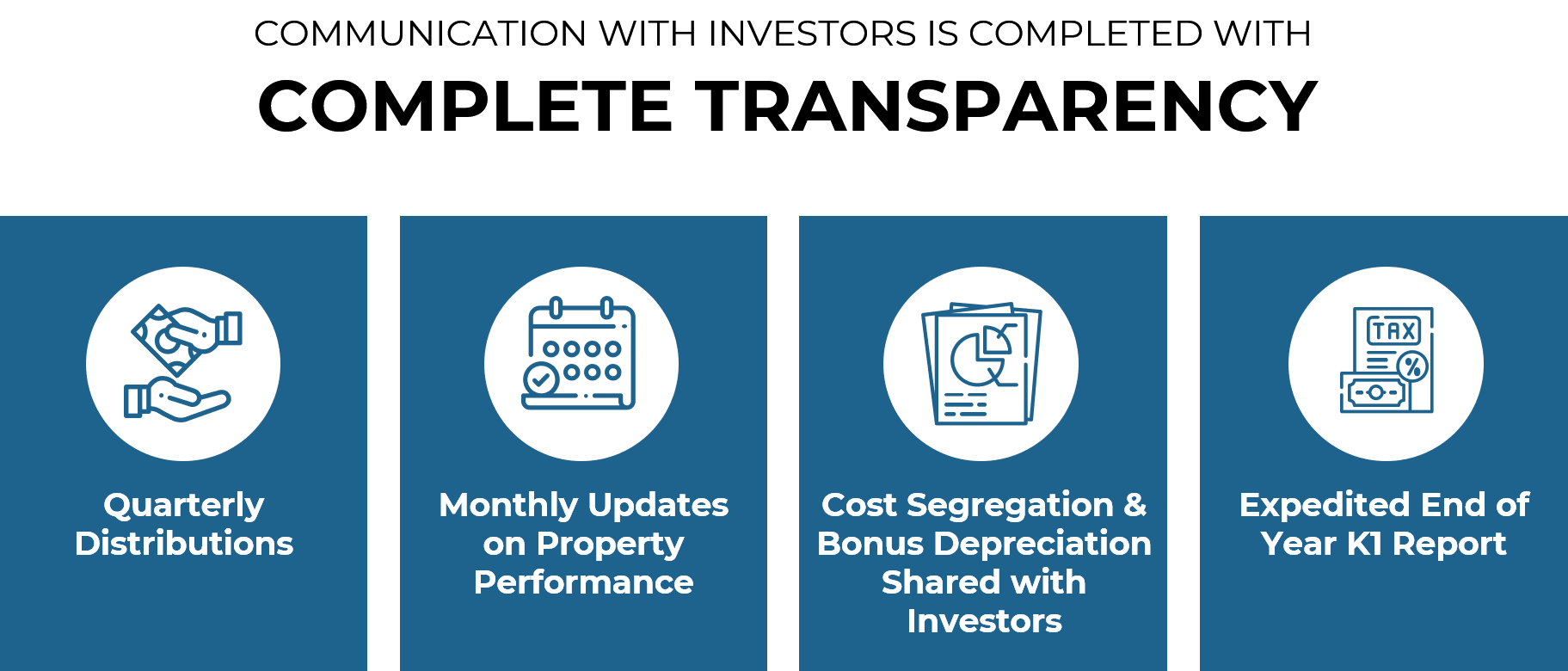

How and when will distributions be made?

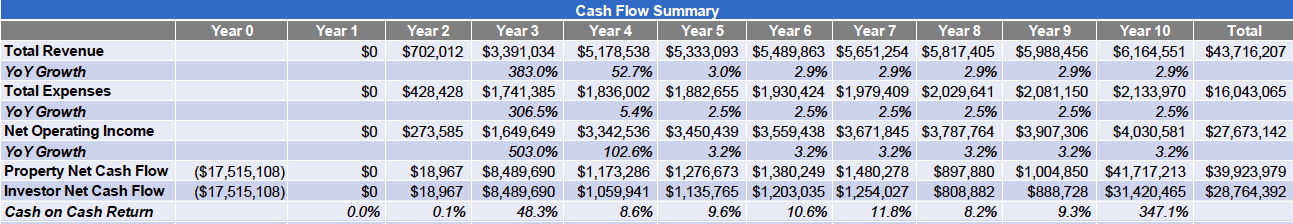

Distributions are anticipated to start in the Spring or Summer of 2023, approx. 12 months from now. We expect quarterly distributions for the duration of the hold.

Is the General Partnership team investing any of their own money?

Sterling Rhino Capital is investing a minimum of $100,000. The larger general partnership team on this project has invested 50% of the total equity.

Will you be doing a cost segregation study that includes bonus depreciation?

We anticipate doing a cost seg study in 2022 on whatever part of the property is "in service". We would expect to see depreciation losses on your 2022 & 2023 K-1 Report.

Can I invest more or less than $100,000?

At this point in time, we are NOT accepting investment amounts other than $100,000. We will let you know if this changes.

THE TEAM

Chris Roberts

Founder & CEO

Sterling Rhino Capital

Paul Wilcox

Co-Founder & COO

Sterling Rhino Capital

Erin Monheim

Director of Investor Relations

Sterling Rhino Capital

For a look at the extended team, lead sponsors, property manager, download the Market Analysis above.